CTA’s latest qualitative survey of coach operator and wholesaler members has reported an upturn for 2025. Insights also suggest strength in Continental tours and premium products. The latest survey of market conditions invited various industry stakeholders to report on current and future business prospects.

Looking at the sector right now, Caroline Thorpe, Marketing Manager at Leger Shearings, says: “Sales are seeing double-digit growth over the prior year, with Shearings — specifically UK sales — trading significantly ahead of the market.”

Sharing a positive outlook for current conditions, Neil Leavesley, Head of Holidays at Skills Holidays, says: “We’ve had a really good start to the year and in Q2 we are showing a 20% increase in both revenue and sales.”

“2025 has started strongly for us and we expect deposited sales for travel this year to be up by around 30% by the end of April compared with the same point in 2024,” says Sean Taggart of Leisuretime by Toureasy. “This follows a similar year-on-year increase in 2024 compared to 2023 and consolidates a trend of rapid and consistent sales growth.”

In further feedback, Acklams Coaches says its UK door-to-door holidays has seen a year-on-year increase of 20% for the start of 2025; Albatross Travel says Q1 2025 was also up in sales and average loadings compared to last year; and Motts Leisure Day Trips are up 15% year-to-date.

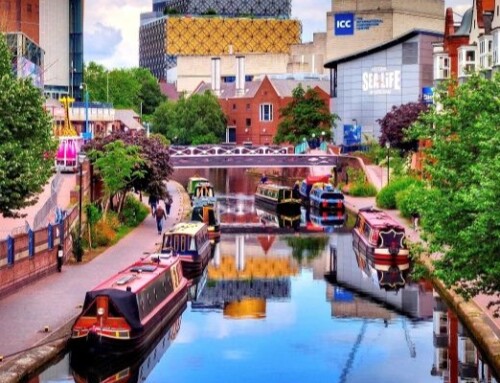

While 2024 saw a renaissance in the European tour market, this trend also continues to grow in 2025 according to CTA members.

“We invested significantly in an increased programme to Europe in 2025 and this is delivering a good proportion of our year-on-year sales growth. Austria and Italy are proving particularly popular,” says Sean Taggart.

“A key driver of this growth is the ongoing resurgence in continental tours, which have seen a 7% year on year increase, supported by increased load factors,” says Louise Fitzpatrick, Head of Sales, Albatross Travel. “This reflects growing consumer confidence, even in the face of operational challenges at the ports.”

Despite the barriers and lack of certainty regarding cross-border travel, Acklams also reports 12% growth in European travel.

Some operators also report that demand for premium-level travel is also strong.

“Luxuria (Leger Holiday’s business-class equivalent brand) demand is at its highest ever, with sales up 19% year-on-year, showing customers’ growing desire for exclusive business-class comfort on the road,” says Caroline Thorpe.

Concerning the forecast for the rest of this year, expectations remain positive.

“Overall, the outlook for the remainder of 2025 remains positive, with full year travelled sales (trips taken place) forecast to rise by 4%,” says Louise Fitzpatrick.

Skills Holidays says bookings for this coming August is up 30% on last year, and Crusader Holidays reports that prospects are good for the remainder of the year – and into 2026.

“Looking ahead to the end of the year, business is doing well, with early bookings for 2026 well up again this year,” says Phil Vockins, General Manager at Crusader Holidays. “It is the third year in a row that early bookings have been up and we are currently 40% up on this time last year.”

Leger Shearings also reports 2026 sales currently 20% ahead of where 2025 departures were at this point in 2024.

Yet alongside strong forward bookings, a continuing trend is late bookings.

“Overall, we have seen an increasingly late booking trend for all destinations, so our advance booking situation is even more encouraging given how much there is still to play for in 2025,” says Sean Taggart.

This view is supported by Neil Leavesley, who adds: “What is clear is the late booking market is especially strong, therefore we need to ensure we’re able to react to that and we work closely with our suppliers to enable us to capture this section of the market – we’ve seen certain products double in sales within six weeks of departure.”

In conclusion, CTA Chair, Robert Shaw, is buoyant about the industry’s outlook.

“The latest reports from our members is extremely positive for the current market, the year ahead, and into 2026,” says Robert. “The coach tourism market is performing strongly, both for UK trips and tours, as well as the resurgence in Continental holidays. This not only shows consumer spending confidence, but also reflects attitudes about the quality of the experience that coach tourism can provide.”

Photo: Innsbruck Tourism.